On one hand Global Energy Crisis is leading to sky high oil prices, while on the other hand COP26 (the 2021 United Nations climate change conference) is debating to bring down fossil fuel (including coal) usage and impose sanctions on countries violating the agreement.

While the cartel of oil producing countries is fleecing money from rest of the world, wouldn’t the developing and poor countries resort to more usage of fossil fuels (including coal) instead of depending on Oil for electricity generation and other purposes?

Global Energy Crisis – Petrol prices in UK

The price of the road fuel reached an all-time high of GBP 1.46 ($1.96 or Rs 145.62 INR ) a liter on Thursday amid stubbornly high oil prices and rising costs for biofuel components in gasoline, one of the nation’s main motoring organizations — the RAC — said Friday. That equates to about GBP 5.52 ($7.40 USD or Rs. 550.17 INR) a gallon (3.78541 Liter). (Source)

The price of diesel also rose to a record GBP 1.50 ($2.01 or Rs. 149.44 INR) a liter in the U.K., according to the RAC.

“Oil is still trading well above $80 and the cost of the bio components of both fuels are higher than ever and retailers are still taking more margin per litre than they traditionally do,” said RAC fuel spokesman Simon Williams. Rising prices will also have an impact on businesses, many of which “tend to be very dependent on diesel, and, in turn, this will lead to a knock-on effect on retail prices potentially adding more fuel to the fire of rising inflation.”

Global Energy Crisis – Gasoline Prices in Canada

In Canada, The average value for Toronto from 26-Jul-2021 to 01-Nov-2021 was 1.62 ($1.29 USD or Rs. 95.96 INR) Canadian Dollar ( with a minimum of 1.56 Canadian Dollar on 23-Aug-2021 and a maximum of 1.71 Canadian Dollar on 25-Oct-2021. For comparison, the average price of gasoline in the world for this period is 2.05 Canadian Dollar ($1.63 USD or Rs. 121.19 INR)

Canada Gasoline prices on 08-Nov-2021 in different currencies (Source)

Litre Gallon

CAD 1.644 6.223

USD 1.321 5.001

EUR 1.140 4.315

INR 98.21 371.765

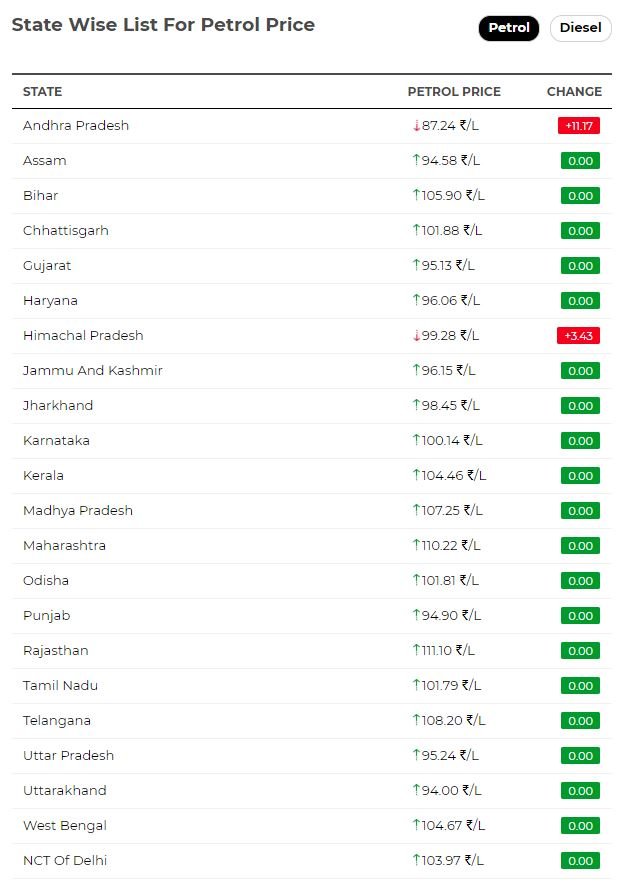

Petrol Prices in India

Here is the list of Petrol Prices per liter as at 06:00 A.M. today i.e. 13-November, 2021 (Source)

Prices of Petrol in India are much lower than that of UK and Canada in several states ruled by the ruling party BJP lead by Indian Prime Minister Narendra Modi after these states matched the central government’s announcement of a cut in excise duty with slashing of local sales tax (VAT) rates. However most of the opposition ruled states are yet to cut the taxes to give similar relief in their states.

Crude Prices in US

Crude prices have surged roughly 60 percent this year. As of Thursday morning, global benchmark Brent crude futures were priced at $83.32 a barrel while US West Texas Intermediate crude futures cost $82.20 a barrel. As per an article, Bank of America has warned $120-a-barrel oil is on the way.

Demand for oil is getting a further boost from skyrocketing natural gas prices. US natural gas has more than doubled this year and recently hit the equivalent cost of $240-a-barrel oil in Europe. High natural gas prices will force some utilities and factories to switch to a relatively cheaper alternative: oil.

Earlier in May 2021, A major US fuel pipeline was forced to shut down after a suspected Chinese cyberattack on one of the largest pipelines in the United States, in what appeared to be a significant attempt to disrupt vulnerable energy infrastructure. Now the International high prices. Doesn’t this smell like a pre-meditated conspiracy?

Related Article US Fuel Pipeline Forced To Shut Down : Chinese Cyberattack Suspected

Global Energy Crisis – Factors causing high prices

While there are many factors that determine the price of retail gasoline, the price of oil is the biggest one, and crude prices around the world have roared back in recent months as supply and demand is proving to be more volatile than usual while the global economy is trying to emerge from the depths of the pandemic.

Like just about everything else, oil prices took a swan dive in the early days of the pandemic. Many Countries announced total lock down starting from mid of March. Many countries banned all commercial and domestic flights and halted all rail and road traffic and enforced social distancing. In big countries like US and India that are among some of the biggest consumers of Oil, the consumption of the oil fell to a great extent since all the economies were brought to a complete standstill and there was no traffic on the roads, nor any vehicles plying on the road that consume a lot of petrol/diesel. All the manufacturing companies were also closed. There was virtually no consumption of oil starting a month before the day of the Oil Market Crash i.e. 20th April 2020. The world economy effectively went into hibernation.

This slowdown went as far as causing the oil price to dip below zero for the first time on record in April of 2020. Oil traders literally couldn’t give away a barrel of oil for free and had to pay money to have people take it off their hands.

April 2020 will be remembered as the Biggest Crash in the History of Oil Trading, a crash engineered by China. It’s not just investors in the largest US oil ETF, the USO, who suffered billions in losses in that week starting 20th April 2020 after WTI plunged, its May contract settling at minus $37.63 on Monday, 20th April 2020: the shockwave from the crash in near-dated crude prices, which forced the USO to halt for trading on several occasions as it scrambles to rebalance daily and purchase as many longer-dated futures as it possibly can to avoid another deliverable disaster and stay in business, has also wiped out countless investors worldwide, many of whom ended up owing money to the bank.

Related Article China Spread Rumors And Crash Oil Market So That OPEC Sell Oil in Distress Sale?

Oil rigs went into survival mode to make it through the pandemic. But as demand started to creep back, so, too, did prices. After dipping below zero barely a year ago, crude prices are now back to their highest level in seven years, and analysts say higher highs are coming.

“We’re probably going to see prices continue to rise through the end of the year unless we see another kind of COVID acceleration,” said Rory Johnston, founder of the Commodity Context newsletter and managing director at Toronto-based investment firm Price Street. (Source)

Even The United States is producing less oil than it did before Covid — even though prices are much higher today.

US oil companies are under enormous pressure from Wall Street to show discipline after many years of overspending on expensive drilling projects. They have heard that message loud and clear and are instead plowing money into share buybacks and dividends.

Despite the 67% spike in oil prices this year, 50 of the largest oil companies have increased their annual budgets by a mere 1% relative to their initial plans, according to a Raymond James analysis.

“We are beyond capital discipline. We are in capital austerity,” said Pavel Molchanov, an analyst at Raymond James.

That strategy has paid off, so far. ExxonMobil (XOM), Chevron (CVX) and other US oil companies reported blockbuster quarterly results in recent days.

Oil companies are also reluctant to ramp up production because the demand outlook remains very uncertain given the climate concerns around the world. Eventually, oil demand is expected to peak, but no one knows precisely when and at what level. (Source)

Can US President Joe Biden do anything to address the global energy crisis?

US President Joe Biden tried asking OPEC and its allies to start pumping oil more aggressively than they were planning to. Because the more supply that comes on to the market, the more it will fall into line with demand and bring down oil prices – and petrol prices. However, US President Joe Biden’s efforts to rein in higher gasoline prices by appealing to the Organization of the Petroleum Exporting Countries (OPEC) and its allies to pump more oil has so far fallen on deaf ears.

At its latest meeting, OPEC and its buddies rejected Biden’s pleas to open the taps more generously. Instead, they decided to stick with their current plan to gradually cast off the production curbs they put in place last year when oil demand was in the basement.

The US president Joe Biden does not have charisma, influence and leverage like the former US President Donald Trump had on Gulf countries during his tenure and ensured that Oil Prices remain in control not only in the US but also globally.

Biden can choose to double down on direct diplomacy with major oil producers, namely Saudi Arabia, to put more barrels on the market — though it’s currently unclear where the administration currently has leverage to really twist the arm of Riyadh.

Points to Ponder

If the cartel of a few Oil producing and exporting countries can hold the world at ransom by keeping the Oil Prices high, shouldn’t the International community also raise the prices of their exports to these nations in the same proportion?

Would US release oil from its Strategic Petroleum Reserve (SPR) and increase oil production?

With no hopes from the US President Joe Biden to rein in the OPEC countries, what can the European Union and other allies do to influence OPEC nations to increase production and reduce Oil prices.

On one hand COP26 is debating to bring down fossil fuel (including coal) consumption and impose sanctions on countries violating the agreement, while on the other hand the cartel of oil producing countries is fleecing money from rest of the world, what would happen to the poor and developing countries worldwide that are already reeling under the economic pressure brought by the Chinese Bio-weapon attack using the Chinese Corona Virus? Wouldn’t the countries resort to more usage of fossil fuels (including coal) instead of depending on Oil for electricity generation and other purposes?

If UN, US, Europe want to drive their agenda on Climate Change, shouldn’t they ensure that the Oil prices remain low and affordable so that developing and poor countries can reduce the fossil fuel consumption? Or is the Climate Change agenda is also a game plan of certain countries to profit?

Follow us at:-

Twitter Handle: @newscomworld

Twitter Handle for Hindi : @NewsWorldHindi

Telegram Handle : @NewsComWorldCom

Koo Handle : @NewsComWorld

GETTR Handle: @NewsComWorld

Parler Handle: @NewsComWorld

Tooter Handle: @NewsComWorld

YouTube Channel https://www.youtube.com/channel/UCnKJQ3gFsRVWpvdjnntQoAA

Facebook Page https://www.facebook.com/NewsComWorld

2,488 total views