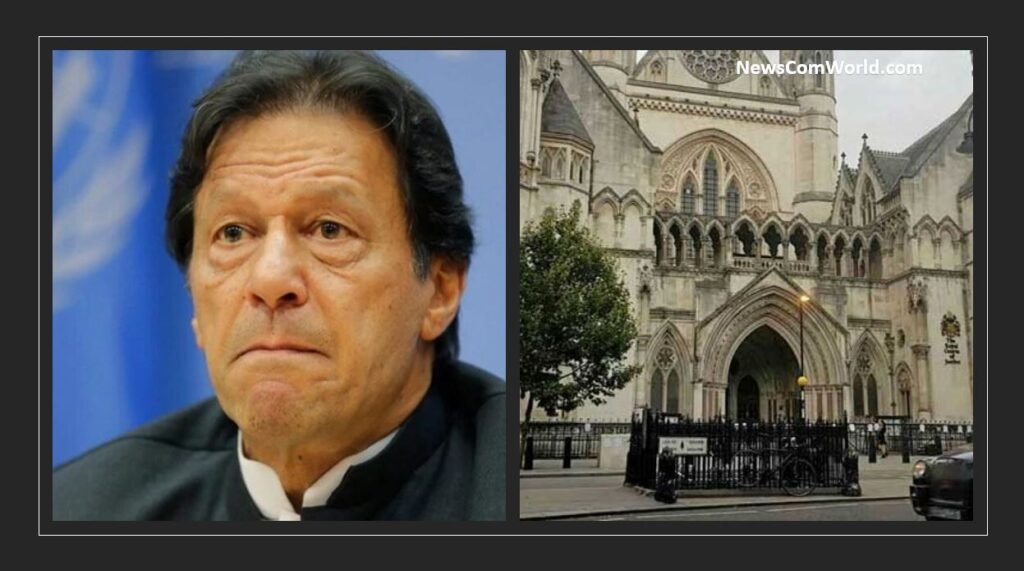

In a big embarrassment and shame to Pakistan, Pakistan London High Commission Accounts can be debited as Pakistan defaulted on its penalty payment to Washington-based company Broadsheet LLC. A high court in London has ordered debiting at least $28.7 million from the accounts of the Pakistan High Commission in London over non-payment of the penalty by Pakistan’s National Accountability Bureau (NAB) to the Washington-based asset recovery firm Boardsheet LLC.

As per the court’s order, the amount had to be debited from the accounts of the Pakistan High Commission in the UK by December 30. The development was also confirmed by Pakistan Foreign Office sources, who said that London had ordered debiting millions of dollars from the Pakistan High Commission accounts.

Referring to the court order, the United Bank Limited UK had also written a letter to the Pakistan High Commission on December 29, requesting to provide written payment instructions along with debit account details to ensure smooth transaction of $28,706,533.35, which should be as per the Final Third Party Order issued by the high court.

Pakistan’s National Accountability Bureau (NAB) was awarded a penalty of $17 million by London Court of International Arbitration (LCIA) in 2018, which was later added with a $3 million case cost. And in March 2019, the court awarded a $20 million final award. NAB had been playing the delaying tactics in submitting the penalty amount of at least $20 million to the country.

As NAB did not pay the amount, addition of interest rate shot up the award amount to $28.7 million.

The penalty slapped with embarrassment on Pakistan’s top anti-corruption watchdog, comes with reference to the case, in which Broadsheet LLC was hired by NAB during Musharraf’s regime to trace hidden assets of 200 Pakistanis, which included former Prime Minister Nawaz Sharif and former President Asif Ali Zardari.

Pakistan Government Cabinet has now approved payment of $28.7 million in damages to the Washington-based asset recovery firm Broadsheet LLC and at the same time decided to challenge the British court’s decision to attach the accounts of the Pakistan High Commission in London, another litigation if lost will again cost Pakistan Exchequer huge costs and more embarrassment and a new precedent wherein assets belonging to Pakistan High Commission and Embassies can be attached or confiscated over non-payment of penalties and dues in future.

The approval was granted after the office of the attorney general and the law ministry advised the government to let the National Accountability Bureau (NAB) clear the $28.7m award.

The government has also decided to fix the responsibility about the debacle internally on those involved in engaging the firm in 2000 during the Pervez Musharraf era, signing a controversial agreement and the payment of $5 million to a ‘so-called representative’ of the firm.

Related Article Pakistan Lost Appeal against Broadsheet. Ordered $33 Million as penalty

“The federal cabinet has given approval for payment of damages to the US-based asset recovery firm,” Adviser to the Prime Minister on Accountability Mirza Shahzad Akbar told Dawn, adding the government would also fix responsibility about the debacle on those involved in engaging the firm on ambiguous terms and already paying the damages amount to a ‘so-called representative’ of the firm.

The adviser said NAB was conducting an investigation against Tariq Malik, who is presently in Dubai, who had paid damages to the so-called front man.

Broadsheet entered into an Asset Recovery Agreement dated June 20, 2000, and did so with the then president of Pakistan General Pervez Musharraf, through the NAB chairman, for the purposes of recovering funds and other assets fraudulently taken from the State and other institutions, including through corrupt practices, and held outside of Pakistan. However in 2003, the agreement was terminated by NAB.

“The arbitration between Pakistan and Broadsheet started during the Pakistan Muslim League-Nawaz (PML-N) government and a settlement was made by the Pakistan Peoples Party (PPP) government, but the money was given to the person who, according to the firm, was not its representadve,” he added.

Meanwhile, a senior NAB official said the bureau had decided to take action against those responsible for the loss and humiliation. “Some officials of NAB, other government departments and Pakistan High Commission in the UK will be under investigation,” he said, adding NAB Chairman Javed Iqbal was also holding a meeting of senior of ficials of the bureau to hx responsibihty on those involved in the fiasco.

An informed source said that both the AG office and the law ministry had advised the government that regardless of facts of the case, the UK high court decision to debit $28.7m from the accounts of the Pakistan High Commission in London over non-payment of the penalty by NAB to the firm should be challenged.

Earlier in July 2020, Broadsheet LLC had threatened to seize visiting Pakistan Cricket Team’s assets in UK. In a letter sent to Islamabad’s counsel, Allen & Overy, the company has argued that the state of Pakistan and NAB have failed to pay the award money it owes, more than 33 million dollars. On top of that they have also refused to engage in any such correspondence for months. “The Pakistan cricket team is currently in the UK preparing for a Test series against England,” the letter sent by Broadsheet LLC says, “We consider that the team is, by the very nature, an asset of the defendant and that monies due to the team and assets of the team are assets of the defendant to the litigation.” It further asks Pakistan’s counsel that if they disagree with the position then they should respond soon or otherwise the company will enforce the warning.

Ignoring the fact that Pakistan High Commission is part of the Islamic State of Pakistan that is liable to pay the penalty Pakistan Government plans to challenge the UK court decision to proceed against the Pakistn High Commission. ‘This should be done to ensure that sovereign immunity accorded to Pakistan and the accounts of its high commission are respected by foreign courts and the present case should not become a precedence to be used against us,’ the source added.

However this decision of Pakistan Government can invite further penalties and costs including legal fees in the event they lose this losing battle and above all the national shame and embarrassment it will face worldwide.

‘This is a sorry tale of gross mishandling by NAB and therefore they should be answerable to the people of Pakistan for this sordid saga,’ he said.

The award of $22m accumulated into $28.7m due to nonpayment of interest, which incurred at a rate of $4,758 per day -an amount also compoundable after every six months, the source said.

The clearing of the penalty was necessary to avoid further recurring of heavy interest, he said.

Usually the accounts of high commissions, embassies and central banks were treated as sovereign assets hence they were immune from being taken over however since Pakistan Government has failed to compensate the claimants, this decision by the UK Court was valid.

Referring to the role of the NAB in this fiasco, the source described the event as a perfect example of ‘how things should not have been done.

This is the second such setback to Pakistan in a row as earlier on Dec 16, 2020, the High Court of Justice in the British Virgin Islands (BVI) granted a stay order ex-parte on a plea by the Tethyan Copper Company for enforcement of July 12, 2019, $5.97 billion award against Pakistan by the International Centre for Settlement of Investment Disputes in the Reko Dig case.

In June 20, 2000 Pakistan initially faced a lawsuit of $580m on a dispute raised by Broadsheet LLC, a company hired for recovery of money and assets plundered by Pakistanis and invested in offshore companies.

An agreement was signed between the firm and NAB to help recover the country’s stolen assets stashed in different offshore companies. But the dispute arose on the payment of service fees which was subsequently referred to international arbitration in London where the litigation before Arbitrator Sir Anthony Evans QC concluded in an interim award in terms of liability under Section 4 and 6 of the Recognition and Enforcement (Arbitration Agreements and Foreign Arbitral Awards) 2011.

Under the agreement, NAB agreed to pay 20 per cent of the recovered or detected amount to the company. The bureau concluded the agreement in May 2008, paying $5m through a settlement agreement with a representative of Broadsheet. But the firm took NAB to the international court of arbitration, claiming that it had not received the amount it was supposed to.

In Dec 2018, former English court of appeal judge Sir Anthony Evans QC issued the order for payment of $22m to Broadsheet by the government of Pakistan. In July 2019, the government filed an appeal against the order, but was unsuccessful in its bid.

The arbitrator found that Pakistan and NAB had wrongfully repudiated the asset recovery agreement with Broadsheet andruled that the company was entitled to damages.

Former prosecutor general of NAB Irfan Qadir said the country faced defeat because the case had not been properly pursued.

He claimed that under internationally recognised doctrine of contra proferentem, any clause considered to be ambiguous should be interpreted against the interests of the party that created, introduced or requested that the clause be included.

Mr Qadir said the firm had inserted a clause in the contract under which it was to get a share not only in assets it will trace outside the country and also in those recoveries to be made in Pakistan by any other organisation like NAB etc. However Irfan Qadir failed to mention that the contract with those clauses was signed by the Government of Islamic State of Pakistan and given a consent to it by signing the agreement.

‘The US firm had not traced even a single asset of any accused of NAB abroad but claimed its share in recoveries made inside Pakistan,’ he added.

However Irfan Qadir failed to mention that NAB is a part of Paksitan Government and is not an independent private organization outside the stucture of Pakistan Government and any award against one body of the Pakistan Governemnt has to be fulfilled by the entire Pakistan Government and that may include any Pakistani Assets Pakistan Government holds outside Paksitan Territory including the assets of Pakistan High Commission.

Precedence this decision of the UK court will have far reaching impact on Pakistan. In future cases any awards against Pakistan can be realized by attaching all Pakistani assets overseas including the properties and assets of Paksitan High Commissions and Embassies.

Reko Diq Case is next in line

The Tethyan Cooper Company (TCC) has approached the High Court of Justice in the British Virgin Islands for the enforcement of the $5.97 billion award against Pakistan by the International Centre for Settlement of Investment Disputes (ICSID) in the Reko Diq case.

Related Article Pakistan Lost Arbitration Proceedings. Slapped with a Penalty of $6 Billion in Reko Diq case.

The Pakistan government is confronted with yet another setback in the Reko Diq case as a high court in the British Virgin Islands has directed it to present assets as bank guarantees to an international arbitrator after Islamabad failed to provide them in the past.

The court has passed an ex parte order on December 16, asking Pakistan to attach details of some of its assets as a guarantee for an international arbitrator.

As per details of the court order, Pakistan will not be able to sell assets managed by offshore companies registered in the British Overseas Territory.

Further details revealed that the Tethyan Copper Company (TCC) had asked Pakistan to provide attachments of these assets for the enforcement of a $6 billion award slapped on the country by the International Centre for Settlement of Investment Disputes (ICSID) on July 12, 2019, after Islamabad revoked the TCC contract for mining at Reko Diq in Balochistan province of the country.

However, the ICSID later stayed the enforcement of the $6 billion award and later on September 17, put out an order, stating that the stay shall continue on a conditional basis.

Related Article ICSID Terminates The Stay : Pakistan to Pay Reko Diq Penalty of $6 Billion Plus Costs

Pakistan was asked to provide unconditional and irrevocable bank guarantee or Letter of Credit (LC) for 25 per cent of the award, plus accrued interest as of date of the decision.

The guarantee or the LC was to come from a reputable international bank based outside of Pakistan, which was pledged in favour of the claimant —the TCC — and to be released on the order of the ICSID.

The ICSID also held that if Pakistan could not furnish the security and undertaking in terms as set out within 30 days after notification of the decision, the stay of enforcement in the amount of 50 per cent of the award, plus accrued interest as of the date of the decision would be lifted.

However, Pakistan missed the deadline and did not deposit 25 per cent bank guarantee.

On November 20, the company had moved the high court for the enforcement of the award which includes attachment of the assets belonging to the Pakistan International Airlines Investment Ltd (PIAIL) — a company which is also incorporated in the British Virgin Islands.

On December 16, the high court had granted a stay order ex-parte without hearing Pakistan, but the government said it will contest the case when it is taken up again on January 7, 2021.

The TCC is a 50-50 joint venture of Barrick Gold Corporation of Australia and Antofagasta PLC of Chile whereas the Reko Diq district in southwest Balochistan is famed for its mineral wealth, including gold and copper.

Later, the ICSID held that if Pakistan fails to provide security and undertaking in terms as set out within 30 days of the notification, the stay of the enforcement in the amount of 50 per cent of the award and accrued interest would be lifted.

As Pakistan failed to meet the deadline, the British Virgin Islands high court has now ordered for provision assets.

Points to Ponder

Shouldn’t Pakistan Pay off its penalties and arrears to all the foreign companies to avoid national embarrassment and shame?

Whenever Pakistan has gone into litigation, Pakistan has ended up in paying higher penalties, Interest and litigation fees that costs millions of additional costs.

One corollary of all these proceedings is that corrupt Pakistan is not an investment friendly country that will honor its agreements and any company or country investing in China controlled terrorist producing Pakistan should do it at their own risk.

Follow us at:-

Twitter Handle: @newscomworld

Instagram Handle: @newscomworld

Parler Handle: @NewsComWorld

Gab Handle : @NewsComWorld

Tooter Handle: @NewsComWorld

Subscribe our : YouTube Channel https://www.youtube.com/channel/UCnKJQ3gFsRVWpvdjnntQoAA

Like our Facebook Page https://www.facebook.com/NewsComWorld

1,725 total views